- Not insured by the FDIC or any other government agency

- Not bank guaranteed

- Not a deposit or obligation

- May lose value

Saving for retirement isn’t always top of mind. It’s one of those things we know we should do, but don’t necessarily focus on.

What most people do consider, however, is maximizing their tax savings. Depending on the options available to you, you can leverage a Roth 401(k) account in combination with your traditional 401(k) account for maximal retirement planning and tax savings.

Using a Roth 401(k) does differ from the traditional 401(k) account, however. This guide provides detailed information about the Roth 401(k) to help you determine what may be best for your financial situation.

A Roth 401(k) is a type of employer-sponsored retirement savings account. Not all employers offer the Roth 401(k), but you should consider participating if so. As of 2020, 86% of 401(k) plans offer a Roth 401(k) option.

Here’s a chart showing how the two 401(k) options compare.

Unlike a traditional 401(k) account, contributions made to the Roth 401(k) are taxed at your current income tax level. In a Roth 401(k), the amount you contribute does not reduce your taxable income or your current income taxes. However, when you withdraw these funds in retirement, you do not pay income taxes on the earnings when it is a qualified distribution.

With a traditional 401(k), contributions are made with pre-tax dollars. Individuals defer money from their paycheck which reduces the taxable income. For example, if an individual makes $45,000 a year and they elect to contribute $5,000 to a 401(k), their taxable income is reduced to $40,000. However, money will be taxed when it is withdrawn in retirement.

There are several nuances about the Roth 401(k) that separate it from other retirement savings vehicles. For people whose employers offer a Roth 401(k), participation is voluntary. However, some employers offer a Roth 401(k) match.

Both types of 401(k) plans have maximum annual contribution limits.

Annual contribution limits are set by the IRS and adjusted for inflation. For 2023, the maximum individuals can contribute to their 401(k) account is $22,500. For reference, the 2022 contribution limit was $20,500. Keep in mind this is a total contribution across 401(k)s accounts so if you have both a traditional and Roth, the combined total cannot exceed $22,500.

For both types of accounts, people aged 50 or older may contribute an additional $7,500 per year as a “catch-up.”

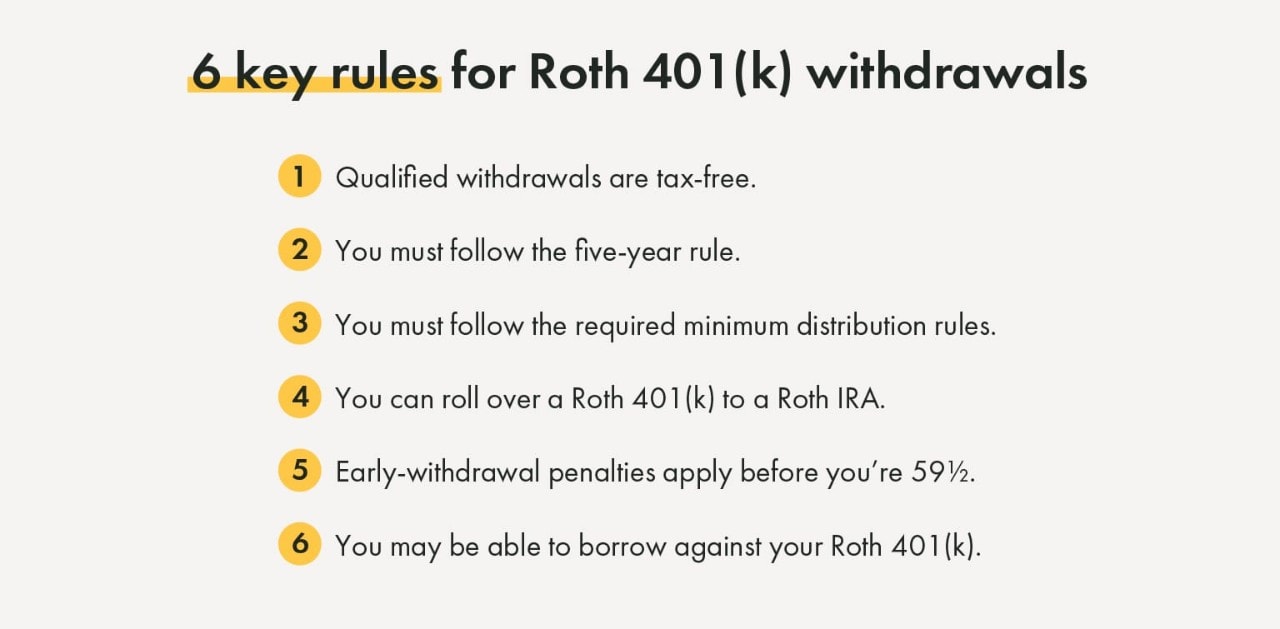

As opposed to a traditional 401(k), withdrawals from a Roth 401(k) account are not taxed. However, this only applies to “qualified” withdrawals where:

Any other withdrawals are subject to a 10% penalty and taxed at your normal income rate—even though you already paid income tax when you made the contribution.

The IRS determines when required minimum distributions (RMDs) must occur. An RMD is just the minimum amount of funds you must withdraw—you can always withdraw more.

The first RMD begins on April 1 following your 72nd birthday (73 if you reach age 72 after December 31, 2022). But if you are still employed at the company which sponsors the Roth 401(k) account, and you’re not a 5% owner of the business, then you may defer the RMD to a later date.

For 2024 and later years, RMDs are no longer required from designated Roth accounts. 2023 RMDs due by April 1, 2024 are still required. The RMD rules are applicable to employer sponsored retirement plans and traditional IRAs. However, Roth IRAs are not subject to the RMD rules while the original owner is alive. Therefore, there is the option once you’re retired to roll your Roth 401(k) plan into a Roth IRA to avoid RMDs during your lifetime.

Like most financial decisions, whether to contribute to a Roth 401(k) account depends on your unique financial circumstances. However, some general considerations apply.

Early in your career, it may be difficult to make post-tax contributions to a retirement savings account. But consider the long-term advantages: Most people retire at an income level significantly higher than the income level at which they began their careers.

This means that the contributions made to your Roth 401(k) could potentially be taxed at a lower rate than the earnings would be if they were taxed at retirement. Considering that the average rate of return for a 401(k) account is 5% to 8% per year, you could save significantly more than a traditional 401(k) account. Another factor to consider is the future of income tax rates, if you believe rates will rise in the future then it is more advantageous to be taxed at today’s income tax rate.

If your employer does not offer a Roth 401(k) account, consider opening a Roth Individual Retirement Account (IRA). The Roth IRA is subject to the same tax structure as the Roth 401(k).

Unlike 401(k) plans, IRAs are not tied to employers. Instead, almost anyone can open an IRA, which is managed by an investment firm or financial institution. Where 401(k) accounts are typically invested in mutual funds and stocks, IRAs typically have a wider mix of security offerings including exchange-traded funds (ETFs) and real estate investment trusts (REITs).

There are income rules associated with Roth IRAs. To be eligible to contribute the maximum amount in 2023, your modified adjusted gross income must be less than $138,000 if filing single or $218,000 if married filing jointly. Contributions are phased out above these amounts.

Other details include:

Saving for retirement doesn’t have to be complicated. While there are several different types of retirement accounts, the best one for you depends on your savings goals and expected earnings. By planning strategically, leveraging a Roth 401(k) might be the best option to maximize your tax and retirement savings.

At Yellow Cardinal Advisory Group, our financial specialists have the experience necessary to help you review your options.

Contact us today to determine whether a Roth 401(k) or other retirement savings strategy is best for you.

1 This limitation is by individual, rather than by plan. You can split your annual elective deferrals between designated Roth contributions and traditional pre-tax contributions, but your combined contributions can’t exceed the deferral limits stated.

401(k) Comparison Table: Adapted from: Roth 401(k) Vs. 401(k): How to Decide Which Plan Is Best for You (businessinsider.com) and Traditional and Roth 401(k)s (FINRA).

Key Withdrawal Rules for Roth 401(k) graphic: Adapted from The Motley Fool by Christy Bieber; https://www.fool.com/retirement/plans/roth-401k/withdrawal/.

The information on this page is accurate as of October 2023 and is subject to change. First Financial Bank and Yellow Cardinal Advisory Group are not affiliated with any third-parties or third-party websites mentioned above. Any reference to any person, organization, activity, product, and/or service does not constitute or imply an endorsement. By clicking on a third-party link, you acknowledge you are leaving bankatfirst.com. First Financial Bank and Yellow Cardinal Advisory Group are not responsible for the content or security of any linked web page.

This material is provided for informational purposes only and should not be construed as investment advice. Guidance provided is educational in nature, is not individualized, and is not intended to serve as the primary basis for your investment or tax-planning decisions. All investing involves risk, including the risk of loss. Investment risk exists with equity, fixed income, and alternative investments. There is no assurance that any investment will meet its performance objectives or that losses will be avoided. Investors should fully understand the risks associated with any investment prior to investing.

You are about to go to a different website or app. The privacy and security policies of this site may be different than ours. We do not control and are not responsible for the content, products or services.

Online banking services for individuals and small/medium-sized businesses.

If you haven't enrolled yet, please enroll in online banking.

Yellow Cardinal resources

* Are not insured by the FDIC. Not a deposit. May lose value.

f1RSTNAVIGATOR is where our business clients can access tools to help manage day-to-day account activity.