- Not insured by the FDIC or any other government agency

- Not bank guaranteed

- Not a deposit or obligation

- May lose value

We make hundreds of decisions every day. Whether selecting an outfit, finding lunch options, or deciding to exercise, each choice informs the remaining course of the day.

Like these daily tasks, we also routinely make important and inconsequential financial decisions. For example, we hire an accountant to file taxes, an estate planner to draft wills, and a financial consultant to manage investments or retirement portfolios. Often these professionals don’t collaborate to meet your financial goals, and the result is a piecemeal approach rather than a comprehensive plan.

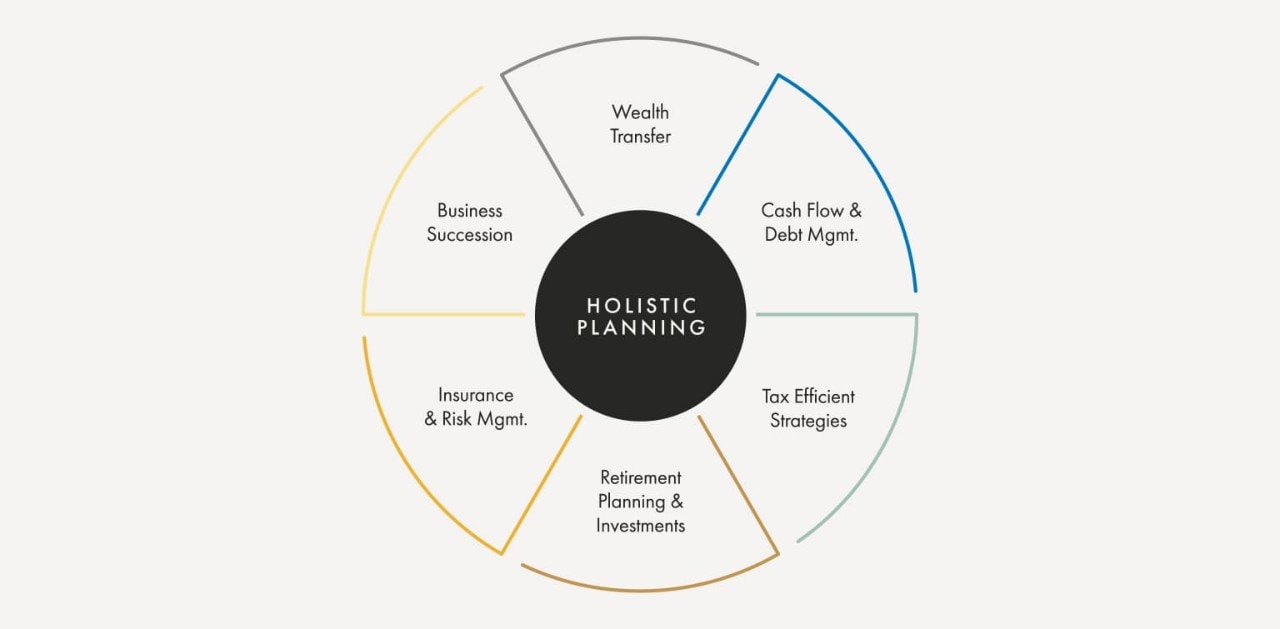

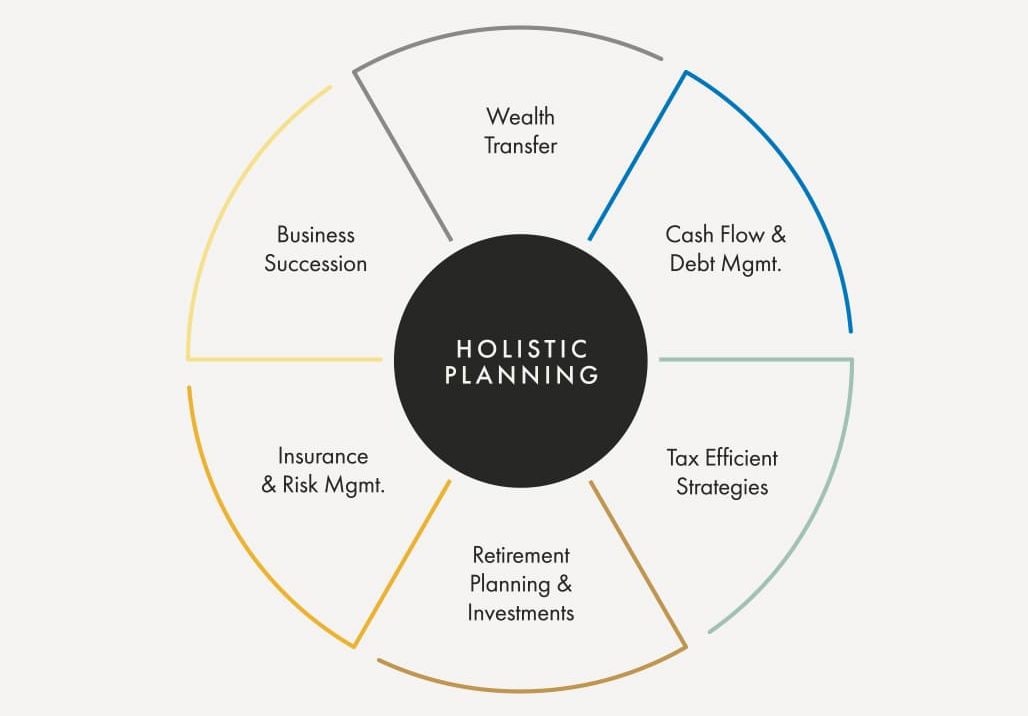

A holistic financial plan, however, is the opposite. A single professional builds a client-centered relationship with you to examine your financial, life, and personal goals. This results in a holistic plan with all facets of your financial and personal life in one package.

Common dictionaries define “holistic” as “relating to or concerned with wholes or complete systems.” Therefore, a holistic financial plan combines all financial elements of your life into a uniform system.

Your advisor will broadly consider budgeting, saving, spending, and investing needs to provide a top-down approach to help you identify:

This approach differs from the traditional bottom-up approach, where a financial advisor focuses instead on your current purchasing power to identify investment opportunities or financial products.

For example, imagine visiting a retirement advisor to determine how much you should save and invest. This advisor enters your age and current income into an equation that spits out the numbers. Now, imagine you visit a second advisor who discusses a number of key planning areas with you like your savings goals, expected lifestyle in retirement, and current and future cash flows in order to build a plan that is unique to you. The latter exemplifies a holistic approach.

A holistic financial advisor will use a “hands-on” approach to get to know you and understand your goals. The advisor’s aim is to create a coordinated, comprehensive financial plan.

As opposed to a holistic approach, consumers have traditionally sought financial advice regarding a particular product or professional service. Most facets of life require an advisor or professional of some capacity, such as:

Under this “purchasing decision” approach to financial planning, each major decision occurs in a vacuum. Your estate planner, accountant, mortgage broker, and investment manager all work independently of each other. Once you’ve finished your taxes, for example, you may not speak intimately with your accountant until next year.

Only you see the big picture.

On the other hand, a holistic planning wealth advisor establishes a relationship where you continuously monitor and reevaluate progress toward major goals. This holistic planning advisor works with other professionals, like a tax planner and accountant, to understand your big picture. While a wealth advisor using a holistic approach still provides an abundance of information, they decipher that information alongside you.

A qualified holistic financial planner will begin by listening to learn and gather as much information as possible about you. This includes a detailed discussion of your goals, assessing your overall financial situation and resources, estimating how your portfolio might perform during retirement, and exploring scenarios to refine and improve your overall financial plan. They will use this information to collaborate effectively with retirement professionals, tax planners, and attorneys.

Although there is no standard model of holistic financial planning, a best-practices approach includes the following:

To achieve these goals, a holistic plan may include a/an:

After these initial interactions with your advisor, expect to meet regularly for check-ups on your progress.

A holistic financial plan makes achieving your goals more realistic. How do you choose a wealth advisor, though?

Consider that wealth or financial advisors may or may not have licenses from accreditation authorities. Simply rendering wealth advice does not require a license in most states, while selling financial products or providing investment advice does.

Other wealth advisors may be CERTIFIED FINANCIAL PLANNER™ (CFPs®). This designation requires advisors to pass an extensive exam, possess a college degree, complete certain financial planning coursework, and obtain three years of full-time experience.

These requirements enable CFPs® to provide advice regarding tax planning, retirement savings, debt planning, investments, and other financial needs. These and other wealth planners work collaboratively with financial advisors and other professionals as well.

A CFP® typically services as a fiduciary, which means they must provide advice with your best interest ahead of their own.

Financial planners using the holistic approach integrate your personal and financial goals.

Advantages include:

A holistic financial plan accounts for your personal life and current financial circumstances. At Yellow Cardinal Advisory Group, our wealth advisors have the professional experience and knowledge necessary to develop your comprehensive, holistic financial plan.

Contact us today to find an advisor near you.

Certified Financial Planner Board of Standards, Inc. (CFP Board) owns the certification marks CFP® and CERTIFIED FINANCIAL PLANNER™ in the United States, which it authorizes use of by individuals who successfully complete CFP Board’s initial and ongoing certification requirements.

The information on this page is accurate as of July 2022 and is subject to change. First Financial Bank and Yellow Cardinal Advisory Group are not affiliated with any third-parties or third-party websites mentioned above. Any reference to any person, organization, activity, product, and/or service does not constitute or imply an endorsement. By clicking on a third-party link, you acknowledge you are leaving bankatfirst.com. First Financial Bank and Yellow Cardinal Advisory Group are not responsible for the content or security of any linked web page.

You are about to go to a different website or app. The privacy and security policies of this site may be different than ours. We do not control and are not responsible for the content, products or services.

Online banking services for individuals and small/medium-sized businesses.

If you haven't enrolled yet, please enroll in online banking.

Yellow Cardinal resources

* Are not insured by the FDIC. Not a deposit. May lose value.

f1RSTNAVIGATOR is where our business clients can access tools to help manage day-to-day account activity.