- Not insured by the FDIC or any other government agency

- Not bank guaranteed

- Not a deposit or obligation

- May lose value

At their core, credit cards let you buy something now and pay later. You are making a purchase using the credit card company’s money. Then, you’ll pay back the purchase with or without interest depending on how long it takes you to pay. If you pay for purchases prior to your monthly due date you won’t get assessed an interest fee. If you need a little more time to pay, you’ll pay some amount of interest depending on your card and rate.

There are quite a few benefits of credit cards when you compare them to other methods of making purchases. Using a credit card responsibly will let you avoid debt and gives you the security that comes with not needing to use cash or your debit card.

Your credit score is like your online dating profile, just for lending companies instead of the cute guy or girl down the street. Lenders use your credit score to determine how likely you are to pay your debts on time and to completion. A good credit score will help you with eligibility for the best interest rates on loans and other credit cards. A great credit score will open opportunities for special credit cards with better rewards.

A credit card is a great way to begin building your credit score. These cards are a form of “revolving” debt because you can borrow at will, up to the amount of your approved credit line. Using a credit card responsibly and paying it off on time or ahead of the due date lets you start showing your creditworthiness to lenders.

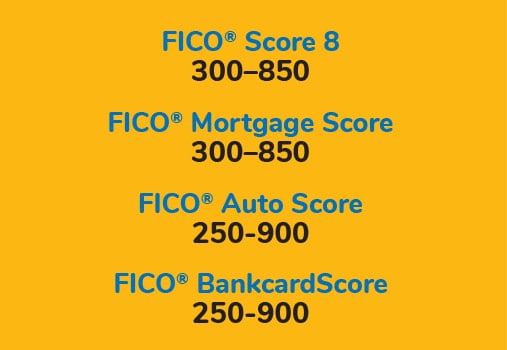

Credit scores impact the types of credit your are eligible for, as well as the interest rates you can expect on loans and credit cards. Not sure where your credit score stacks up? Here is an example of the score breakdowns for one of the commonly used reporting bureaus, FICO. A score ranging from 300-579 is considered poor, 580-669 is considered fair, and 670-739 is considered good. Higher scores are more difficult to build, but will provide access to better credit products. Scores of 740-799 are considered very good and 800-850 is exceptional.

When you use cash or a debit card you are using your own money to make a purchase. That means if something goes wrong, you fall victim to fraud, or your card information gets stolen, it is your money that immediately comes out of your account. When this happens, you’ll be without your money while your bank investigates. It may take several days or weeks before you receive a refund.

Credit cards come with more protections including fraud protection. When you make a purchase using a credit card you are doing so using the card issuer’s money. If your credit card information gets used to make a fraudulent purchase, in most cases all you need to do is alert the card issuer and they will investigate and dispute the claim on your behalf.

While not every credit card offers reward points, the ones that do reward you with points for every dollar you spend. For example, if you spend $25 on Netflix, you’ll get 25 points to use on something else. You can then redeem these points towards travel, cash back rewards, or to pay off future purchases with statement credits.

Some credit cards even offer promotional sign-up bonuses. These bonuses usually require you to spend a certain amount of money in the first 1-3 months after receiving the card and reward you with bonus points. These promotions vary, so it is important to shop around when looking for a credit card.

Do you have high interest debt spread out on a few different credit cards? Balance transfers let you combine the balances from other cards into one account, often at a lower interest rate than the other cards. This makes it easier to manage your debt and saves you money in interest payments.

Some credit cards offer promotional 0% balance transfer bonuses. This lets you combine your debt in one place and pay it down with no interest payment for a fixed amount of time. If you are considering this route, remember it is important to pay off the debt during the 0% promotion, or you will have to pay interest on the balance from the beginning when the promotional rate expires.

Credit cards are a great way to avoid applying for a loan if you need to borrow some money for a short amount of time. Because a credit card is a rotating credit line, you can borrow against it at any time whenever you need money. Interest rates on credit cards are typically higher than you’d receive on a personal loan (but nowhere near as high as a payday loan) so you should have a plan to pay off what you borrow as quickly as you can.

Credit cards can be an important part of a healthy personal financial life. Like any tool, credit cards have pros and cons, so using one responsibly is key. Not sure what credit card is best for you?

The information on this page is accurate as of April 2021 and is subject to change. First Financial Bank is not affiliated with any third-parties or third-party websites mentioned above. Any reference to any person, organization, activity, product, and/or service does not constitute or imply an endorsement. By clicking on a third-party link, you acknowledge you are leaving bankatfirst.com. First Financial Bank is not responsible for the content or security of any linked web page. Member FDIC / Equal Housing Lender.

You are about to go to a different website or app. The privacy and security policies of this site may be different than ours. We do not control and are not responsible for the content, products or services.

Online banking services for individuals and small/medium-sized businesses.

If you haven't enrolled yet, please enroll in online banking.

Yellow Cardinal resources

* Are not insured by the FDIC. Not a deposit. May lose value.

f1RSTNAVIGATOR is where our business clients can access tools to help manage day-to-day account activity.